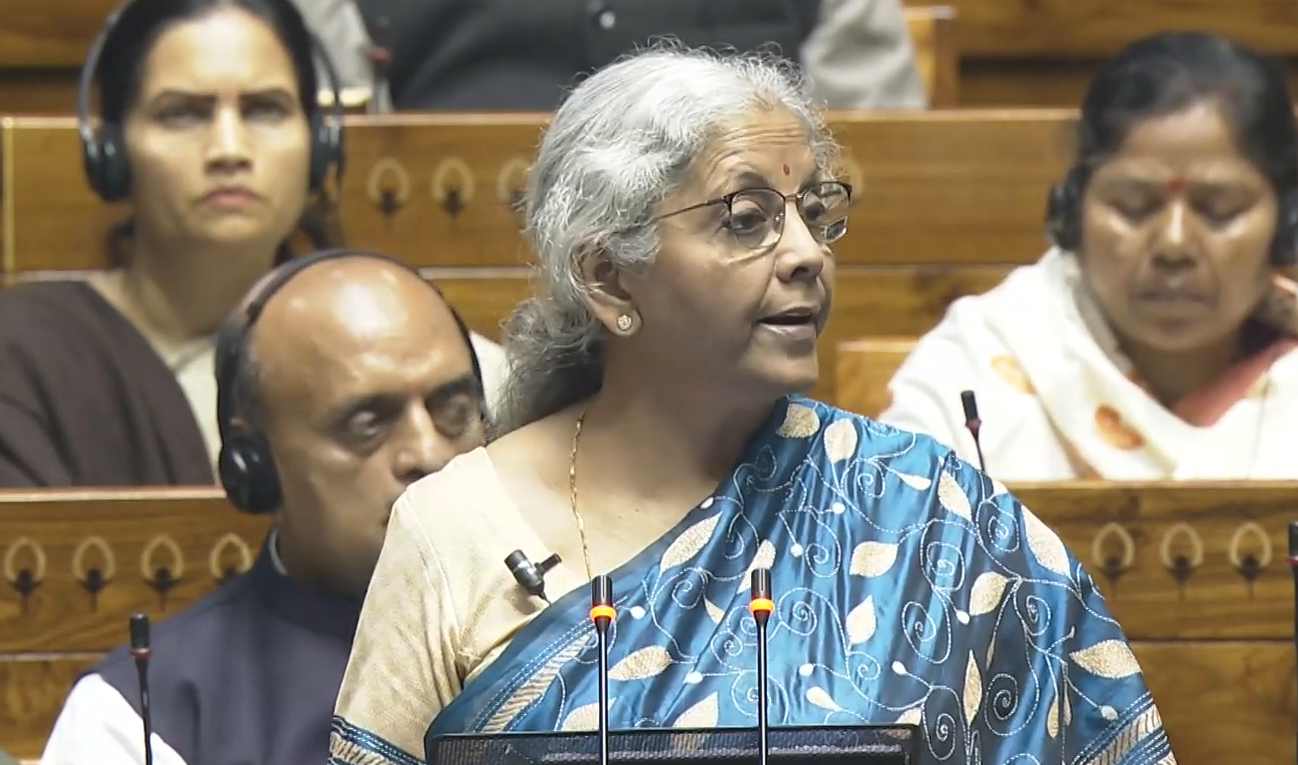

Finance and Corporate Affairs Minister Smt Nirmala Sitharaman presented the Interim Union Budget for 2024-2025 in Parliament on Thursday.

The capital expenditure outlay for the next year has been increased by 11.1%, reaching Rs 11,11,111 crore, accounting for 3.4% of the GDP, according to the Finance Minister.

Highlighting the economic achievements, she stated, “The massive tripling of capital expenditure in the past 4 years has had a huge multiplier impact on economic growth and employment creation.” The First Advance Estimates of National Income project India’s Real GDP to grow at 7.3% in FY 2023-24, aligning with the RBI’s revised projection of 7%.

Sitharaman expressed confidence in India’s economic resilience amid global challenges. The IMF revised its growth projection for India upwards to 6.3% for FY 2023-24, emphasizing the country’s increasing contribution to global growth.

The Finance Minister reported robust revenue collections, with GST reaching ₹1.65 lakh crore in December 2023, marking the seventh time gross GST revenues crossed ₹1.6 lakh crore.

Looking ahead to 2024-25, the total receipts, excluding borrowings, and total expenditure are estimated at Rs 30.80 lakh crore and Rs 47.66 lakh crore, respectively, with tax receipts projected at Rs 26.02 lakh crore.

A major highlight is the continuation of the fifty-year interest-free loan scheme for capital expenditure to states, with a total outlay of Rs 1.3 lakh crore, supporting Viksit Bharat reforms.

Sitharaman emphasized fiscal consolidation, aiming for a fiscal deficit of 5.1% of GDP in 2024-25, adhering to the path outlined in the Budget Speech for 2021-22.

In a positive economic outlook, she announced India’s FDI inflow from 2014-23 at USD 596 billion, signalling a golden era. Efforts to negotiate bilateral investment treaties aim to encourage sustained foreign investment.

The Finance Minister reiterated Prime Minister Narendra Modi’s focus on the four major castes: ‘Garib’ (Poor), ‘Mahilayen’ (Women), ‘Yuva’ (Youth), and ‘Annadata’ (Farmer). She underscored the government’s commitment to their needs and aspirations, calling them the highest priority.

Sitharaman outlined the government’s all-encompassing development approach, moving beyond village-level provisioning in the last decade. Initiatives like ‘housing for all,’ ‘hargharjal,’ and financial services for all have contributed to India’s progress.

The Finance Minister announced a golden era for tech-savvy youth, with a corpus of Rs 1 lakh crore providing a fifty-year interest-free loan to encourage research and innovation.

Key developments in sectors include railway corridor programs, aviation sector growth, and the formation of a high-powered committee to address challenges arising from population growth and demographic changes.

No changes in taxation have been proposed in the Interim Budget, maintaining tax rates for direct and indirect taxes. Tax benefits for Start-Ups and investments by sovereign wealth or pension funds have been extended. Outstanding direct tax demands up to Rs 25,000 and Rs 10,000 for specific periods will be withdrawn, benefiting around a crore taxpayers.

Sitharaman commended taxpayers, highlighting the tripling of direct tax collections over the last decade. The Minister emphasized the government’s focus on improving taxpayer services, simplifying tax returns, and reducing processing time.

On GST, Sitharaman stated that it has reduced compliance burdens, with the tax base doubling and the average monthly gross GST collection almost doubling to Rs 1.66 lakh crore this year.

To provide insights into the economic journey from 2014 to the present, the government will release a white paper, drawing lessons from the challenges faced during those years.

The Finance Minister expressed optimism about India’s economic transformation in the last ten years, with the government’s efforts aligning with the empowered energy of the people. She affirmed that a detailed roadmap for ‘Viksit Bharat’ would be presented in the full budget in July.